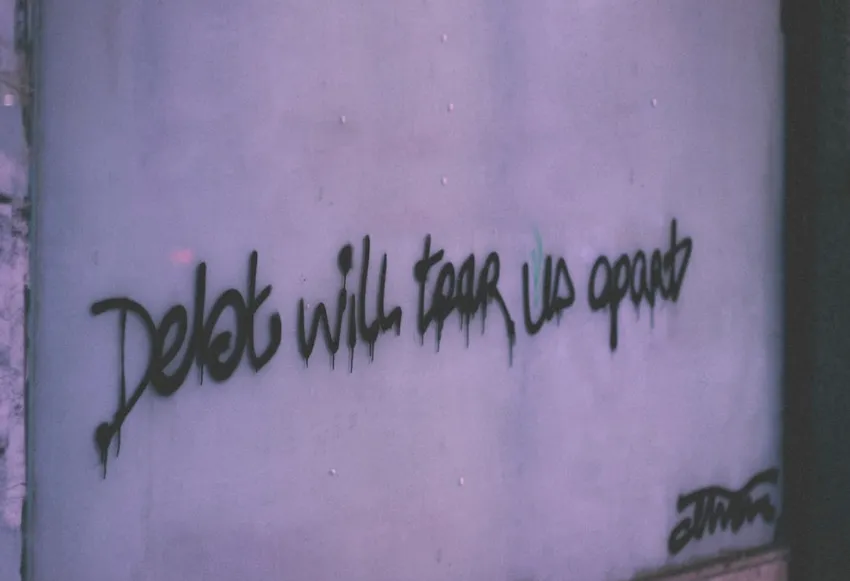

Are you burdened by high-interest debt and looking for a way to free yourself from its grasp? Paying off debt can be an uphill battle, but there's a powerful tool that can help you gain control of your finances: a home equity loan. In this article, we will explore the concept of paying off debt with a home equity loan and uncover the benefits and considerations of utilizing this financial tool. We'll also delve into the features of MyHomeEquity, a leading provider of home equity loans, and how it can assist you in your journey towards financial freedom.

Understanding Home Equity Loans

Before we dive into the specifics of paying off debt with a home equity loan, let's first ensure we have a clear understanding of what a home equity loan entails. A home equity loan, also known as a second mortgage, allows homeowners to borrow money against the equity they have built up in their property. Start building an understanding of your keyword by explaining what it does and why it's important. Providing a brief introduction will capture the reader's attention and encourage them to continue reading.

The Power of Home Equity

Home equity represents the current market value of your home minus any outstanding mortgage balance. As you make mortgage payments over time, you build equity in your home, which can be a valuable asset. Unlike other types of loans, a home equity loan offers unique advantages:

-

Lower Interest Rates: Home equity loans often come with lower interest rates compared to credit cards, personal loans, or other forms of debt. This lower interest rate can save you a significant amount of money in interest payments over the life of the loan.

-

Tax Benefits: In many countries, the interest paid on a home equity loan is tax-deductible. This tax deduction can further reduce the cost of the loan and provide additional financial relief.

-

Flexible Use of Funds: Unlike some loans that restrict the use of funds to specific purposes, a home equity loan provides you with the flexibility to use the funds however you see fit. Whether you want to consolidate debt, fund home improvements, pay for education, or cover unexpected expenses, the choice is yours.

Paying Off Debt with a Home Equity Loan: The Strategy

Now that we've covered the basics of home equity loans, let's explore how they can be used strategically to pay off debt. The main concept is to use the funds from a home equity loan to pay off high-interest debt, such as credit card balances or personal loans. By doing so, you can potentially:

-

Reduce Interest Payments: High-interest debt can be a significant financial burden, with interest rates often surpassing 20% or more. By consolidating these debts into a lower-interest home equity loan, you can save money on interest payments and accelerate your journey towards debt freedom.

-

Simplify Finances: Managing multiple debts with different payment due dates and interest rates can be overwhelming. By consolidating your debts into a single home equity loan, you streamline your finances, making it easier to track payments and stay on top of your debt repayment plan.

-

Boost Credit Score: Carrying high levels of credit card debt can negatively impact your credit score. By paying off these debts with a home equity loan, you not only reduce your overall debt load but also improve your credit utilization ratio, which is a key factor in determining your creditworthiness.

Introducing MyHomeEquity: Your Partner in Debt Repayment

When it comes to choosing a provider for your home equity loan, it's essential to work with a reputable company that offers excellent service and competitive rates. Enter MyHomeEquity, a leading provider of home equity loans dedicated to helping individuals like you pay off debt and achieve their financial goals.

Competitive Rates and Flexible Terms

MyHomeEquity understands the importance of providing its customers with affordable rates and flexible terms. By leveraging their extensive network of lending partners, they can offer highly competitive interest rates on home equity loans. Additionally, their loan terms can be tailored to meet your specific needs, allowing you to choose a repayment plan that works best for you.

Streamlined Application Process

Applying for a home equity loan can sometimes be a tedious process, but MyHomeEquity strives to make it as seamless as possible. With their user-friendly online application, you can complete the necessary steps from the comfort of your own home. The application process typically involves providing details about your home, including its value and any existing mortgage balance, as well as your personal financial information.

Personalized Debt Repayment Strategy

At MyHomeEquity, the focus is not just on providing you with a loan, but also on assisting you in crafting a personalized debt repayment strategy. Their team of experts will work closely with you to understand your financial goals and develop a comprehensive plan to pay off your debts efficiently. By analyzing your current debt situation, they can provide tailored recommendations on how to leverage a home equity loan to achieve optimal results.

Customer Support at Your Fingertips

Navigating the world of home equity loans can be overwhelming, especially if it's your first time. MyHomeEquity recognizes this and has a dedicated customer support team ready to answer any questions or concerns you may have along the way. Whether you need clarification about the application process, want to understand the terms of your loan, or seek guidance on debt repayment strategies, their knowledgeable professionals are there to assist you.

Considerations Before Taking the Leap

While a home equity loan can be a powerful tool for paying off debt, it's essential to carefully consider a few factors before proceeding:

-

Debt Consolidation Alternatives: Before committing to a home equity loan, explore alternative options for consolidating your debt. These may include balance transfer credit cards with introductory 0% APR offers, personal loans, or even negotiating directly with your creditors for lower interest rates. Assess the pros and cons of each alternative to determine which solution aligns best with your financial circumstances.

-

Risks of Default: Although a home equity loan offers various advantages, it's crucial to remember that your home is the collateral for this loan. If you are unable to make the required payments, you risk foreclosure and the loss of your home. Before opting for a home equity loan, ensure that you have a stable financial situation and the ability to meet your financial obligations.

-

Qualification Requirements: Every lender has specific qualification requirements for home equity loans. These requirements typically include factors such as credit score, loan-to-value ratio, and overall level of debt. Before pursuing a home equity loan, review your financial profile and ensure you meet the lender's criteria. If necessary, take steps to improve your credit score or reduce your overall debt load to increase your chances of approval.

Conclusion

Paying off debt with a home equity loan can provide a pathway to financial freedom. The combination of lower interest rates, potential tax benefits, and the flexibility of using loan funds as needed makes it an attractive option for individuals seeking debt consolidation solutions. When considering a home equity loan, remember the importance of partnering with a reputable lender like MyHomeEquity. Their competitive rates, streamlined application process, personalized debt repayment strategies, and knowledgeable customer support team set them apart as a trusted choice. Carefully weigh the considerations outlined in this article, and take the necessary steps to ensure that a home equity loan is the right solution for your unique financial situation. By leveraging the power of your home equity wisely, you can pave the way towards a brighter financial future.