Welcome to a comprehensive guide on American Express® Personal Savings Account. In this article, we will explore the features, benefits, and advantages of this powerful financial tool. Whether you are looking to save money for a rainy day or achieve specific financial goals, the American Express® Personal Savings Account offers a range of benefits to help you thrive on your financial journey.

Introduction to American Express® Personal Savings Account

American Express® is a trusted and well-known name in the finance industry. With a history spanning over 170 years, American Express® has built a reputation for providing reliable and innovative financial services. The Personal Savings Account is one of their flagship offerings, designed to empower individuals with a secure and convenient savings solution.

Understanding the American Express® Personal Savings Account

The American Express® Personal Savings Account is an online savings account that allows individuals to earn competitive interest rates on their savings while enjoying the flexibility and convenience of online banking. With no monthly fees or minimum balance requirements, this account is easily accessible and optimized for modern financial needs.

Key features of the American Express® Personal Savings Account:

- High Yield Savings: The account offers a competitive interest rate, allowing your savings to grow faster compared to traditional savings accounts.

- Online Access: With 24/7 online access, you can conveniently manage your savings anytime, anywhere.

- Secure and FDIC Insured: Your funds are protected by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed by law.

- No Monthly Fees: You won't be charged monthly maintenance fees, allowing you to maximize your savings.

- No Minimum Balance Requirements: Whether you are starting with a small amount or aiming for larger savings goals, there are no minimum balance requirements.

Benefits of the American Express® Personal Savings Account

By choosing the American Express® Personal Savings Account, you gain access to a range of benefits that help you optimize your savings strategy and achieve your financial goals.

- Competitive Interest Rates: The account offers a high yield compared to traditional savings accounts, allowing you to earn more on your savings over time. The power of compound interest can significantly boost your wealth accumulation efforts.

- Online Convenience: Accessing and managing your account is seamless with the online platform. You can transfer funds, set up automatic savings plans, and track your progress with ease.

- FDIC Insurance: The peace of mind that comes with FDIC insurance ensures that your funds are protected, even in uncertain times. This added layer of security helps you maintain confidence in your financial future.

- No Monthly Fees: The American Express® Personal Savings Account is designed to empower you with savings, not drain your funds with unnecessary fees. By eliminating monthly maintenance fees, you can save every dollar you earn.

- Flexibility: Whether you are saving for a specific goal or building an emergency fund, the American Express® Personal Savings Account offers the flexibility to adapt to your changing financial needs. You can set up multiple savings accounts to manage different goals simultaneously.

Unveiling the Power of American Express® Personal Savings Account

Building Wealth with High Yield Savings

The American Express® Personal Savings Account allows you to leverage the power of high yield savings to grow your wealth. By earning a competitive interest rate, your savings have the potential to compound over time, resulting in significant financial growth.

In today's low-interest-rate environment, traditional savings accounts often offer minimal yields, making it challenging to achieve long-term financial goals. However, by choosing the American Express® Personal Savings Account, you can take advantage of higher interest rates, helping your money work harder for you.

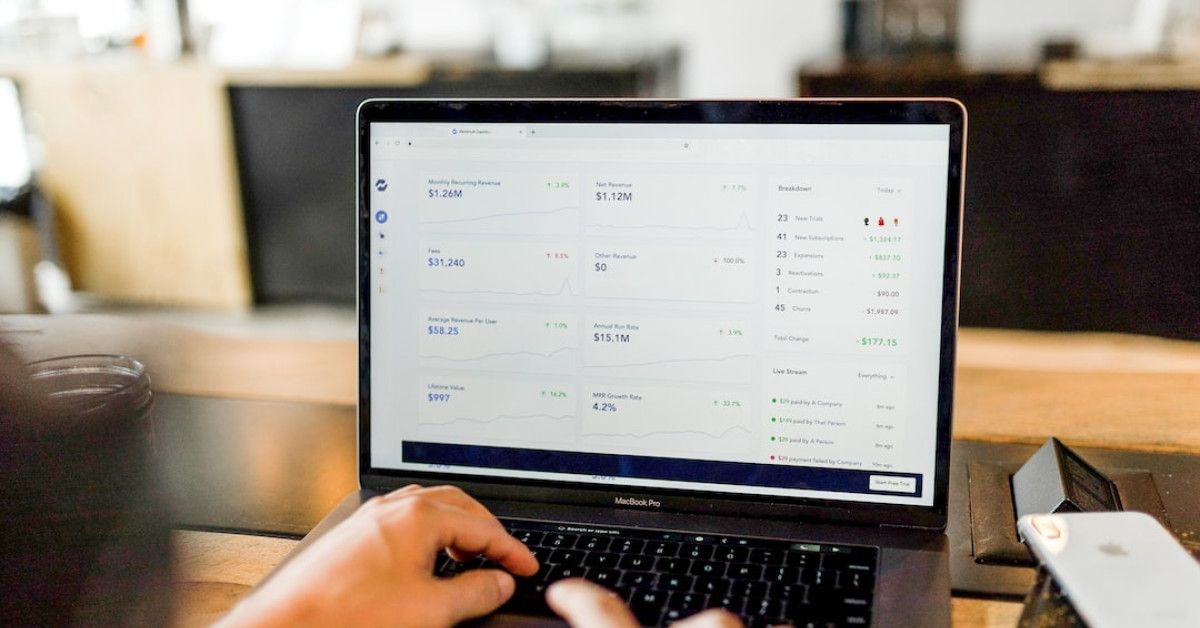

The Convenience of Online Banking

Gone are the days of visiting a physical bank branch to manage your savings. With the American Express® Personal Savings Account, you can conveniently access your funds and perform banking transactions online.

The online platform offers a user-friendly interface, allowing you to transfer funds, view transaction history, and set up automatic savings plans. This level of convenience empowers you to manage your savings efficiently while saving time and effort.

Safety and Security

When it comes to managing your finances, safety is a top priority. The American Express® Personal Savings Account ensures the security of your funds through the FDIC insurance. FDIC insurance provides depositors with up to $250,000 of coverage per depositor, giving you peace of mind and protecting your hard-earned savings.

Additionally, American Express® implements robust security measures to safeguard your online transactions. With advanced encryption technology and multi-factor authentication, your account remains secure from unauthorized access.

A Fee-Free Approach

Monthly maintenance fees can eat into your savings and impede your progress towards financial goals. One of the standout features of the American Express® Personal Savings Account is its fee-free approach. There are no monthly maintenance fees, allowing you to maximize your savings without unnecessary charges.

By eliminating fees, American Express® empowers you to allocate every dollar towards building your wealth. This transparent approach ensures that your savings efforts remain effective and enables you to make the most of the high yield savings account.

Setting and Achieving Financial Goals

The flexibility of the American Express® Personal Savings Account enables you to set and achieve your financial goals effectively. Whether you are saving for a down payment on a house, planning a vacation, or creating an emergency fund, this account supports your objectives.

The online platform enables you to set up multiple savings accounts, each designated for a specific goal. By creating separate accounts, you gain clarity on how much progress you have made towards each goal and can adjust your savings strategy accordingly.

How the American Express® Personal Savings Account Compares to Other Savings Options

To fully understand the power of the American Express® Personal Savings Account, it is helpful to compare it with other savings options available in the market. Below is a comparison chart showcasing the key differences:

| American Express® Personal Savings Account | Traditional Savings Account | Certificate of Deposit (CD) | |

|---|---|---|---|

| Interest Rate | Competitive | Low | Varies |

| Online Access | Yes | Limited | Limited |

| FDIC Insured | Yes | Yes | Yes |

| Monthly Fees | None | Varies | None |

| Minimum Balance Req. | None | Varies | Varies |

| Flexibility | High | Limited | Limited |

As seen in the comparison chart, the American Express® Personal Savings Account offers a range of advantages over traditional savings accounts and certificates of deposit (CDs). The competitive interest rates, online access, lack of monthly fees, and flexibility make it an attractive option for individuals looking to maximize their savings.

Conclusion

The American Express® Personal Savings Account is a powerful tool for individuals seeking a secure, convenient, and effective savings solution. With its competitive interest rates, online access, fee-free approach, and flexibility, this account empowers you to build wealth, achieve financial goals, and secure your future.

By choosing the American Express® Personal Savings Account, you unlock the potential to outperform traditional savings accounts and grow your savings faster. Start your journey to financial freedom with American Express®, and experience the power of a personalized savings account.